Ambition Delivered | finnCap October Update 2021

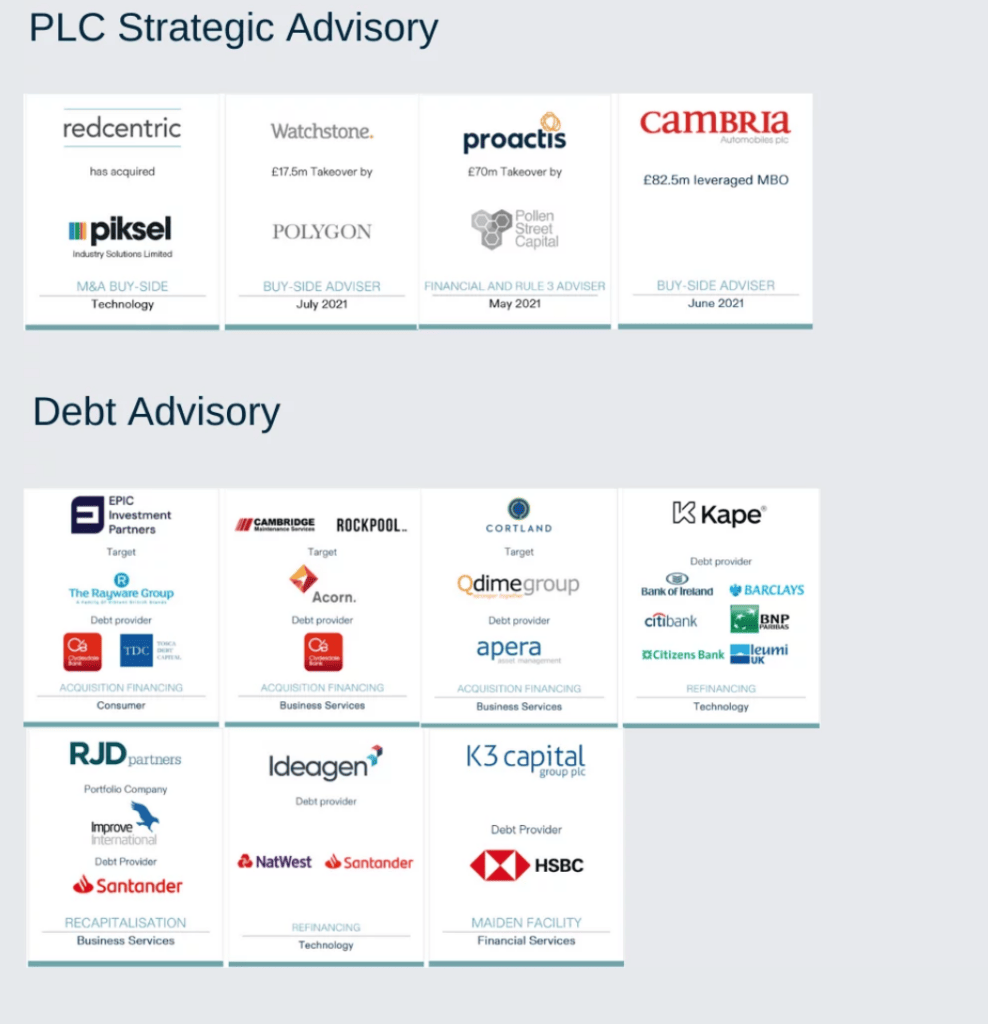

Sizeable equity raisings, debt financing deals, and M&A activity in both public and private markets has driven how we’ve delivered our clients’ ambitions.

Notable deals such as the sale of Pimlico Plumbers, or the sale of Nuapay to an Australian-listed payments technology company for €108 million, were characterised by our team’s broad international reach.

Over the first half of this financial year we also advised Poolbeg Pharma with its IPO; advised Access Intelligence on its acquisition of an Australian firm, raising £50m to fund the deal; advised ANGLE on its £20m Placing; and our Debt Advisory team worked buy-side on behalf of Cortland to finance its acquisition of Qdime, while the finnCap Cavendish team advised Qdime on its sale.