2025 Update

Financial Services Advisory

By Cavendish“In a year defined more by selectivity than volume, financial services M&A rewarded clarity of business model and operational discipline.”

Partner & Head of Financial Services, M&A

Despite ongoing macroeconomic uncertainty, 2025 proved a year of resilience and selective recovery across UK and European financial services. While interest rate volatility and regulatory scrutiny continued to influence transaction dynamics, deal activity remained robust in areas demonstrating strong cash generation, contracted or recurring revenue models and clear strategic relevance. Investors continued to favour businesses enabling efficiency, scalability and regulatory resilience across financial markets.

Against this backdrop, Cavendish advised on a range of transactions across payments, asset and wealth management and fintech, including insurtech and wealth tech, reflecting both the depth of our sector expertise and the market’s evolving priorities.

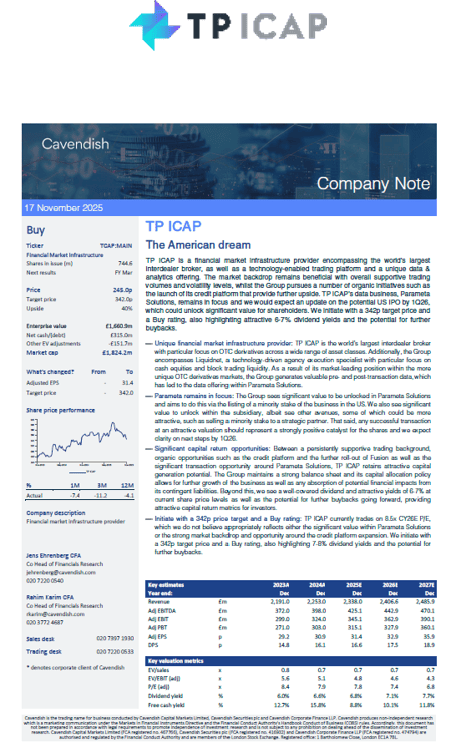

- Top ranked financials research team – Top-ranked research team with wealth of experience (ranked #1 and #2 in the 2025 Extel survey)

- Strong track record with corporate clients – Wealth of experience of working with a wide range of corporate clients

- Broad and deep coverage – Diverse coverage range focused on increasing investor interest and developing wider conversations

- Differentiated product – Differentiated approach to research product across single stock, thematic and sector notes

- Greater distribution – ensuring all corners of the market are reached, including all of the UK’s institutional investors and self-certifying professional investors

Selective investments across payments and fintech

Payments remained one of the most active subsectors during 2025. Demand was particularly strong for platforms with embedded distribution, high-frequency transaction flows and mission-critical infrastructure, including PSPs, FX and treasury platforms and settlement and orchestration technologies.

Payments remained one of the most active subsectors during 2025. Demand was particularly strong for platforms with embedded distribution, high-frequency transaction flows and mission-critical infrastructure, including PSPs, FX and treasury platforms and settlement and orchestration technologies.

In cross-border payments, the market remains highly fragmented. Without sector specialism, differentiation is increasingly difficult, making consolidation a natural route to scale, whether that capability is built or acquired.

Resilience in asset and wealth management

Wealth management demonstrated notable activity, with eight transactions completed over the past two years. Strategic buyers and private equity sponsors continued to pursue platforms offering recurring fee income, high-quality client bases, defined by age demographics, average client AuM and location, and integrated operating models. In particular, organic AuM growth remains one of the strongest drivers of EBITDA multiples.

Beyond traditional wealth management, technology-enabled propositions are increasingly attractive. Advances in technology are enabling the under-served mass affluent segment to receive guidance and advice on an economic basis, supporting scalable growth models.

Momentum in technology-enabled insurance and MGA platforms

Technology-enabled insurance businesses and MGA platforms attracted growing strategic and private equity interest in the UK during 2025, reflecting demand for capital-light growth within a regulated market. Activity centred on MGAs with strong underwriting discipline, durable capacity relationships and differentiated distribution, where value is driven by structure and execution as much as topline growth.

From an M&A perspective, outcomes increasingly depended on the sustainability of loss ratios, revenue visibility and the contractual alignment between MGAs, capacity providers and distribution partners. Technology played a critical enabling role, supporting pricing discipline, delegated authority governance and operational leverage. Well-structured platforms with recurring commission income and scalable models continued to attract strong interest, reinforcing the importance of specialist M&A advice in this segment.

Private equity influence

Private equity remained a major driving force in mid-market financial services dealmaking throughout 2025. US private equity in particular increasingly views the UK as a base for new investment. During the year, Lee Equity Partners and Charlesbank Capital Partners both invested in roll-up vehicles within the wealth sector.

Payments and fintech, including insurtech and wealth tech, should remain active where structural growth drivers are clear. Consolidation across asset and wealth management and fund administration is expected to continue as scale, technology and regulatory capability become increasingly critical. Private equity will remain a key force, particularly in resilient, cash-generative businesses where operational improvement and disciplined integration can drive value.

Taken together, these factors point to a market where quality assets should continue to transact, even if volume recovery remains measured rather than exuberant.

Cavendish Financial Services expertise

We continue to work closely with founders, management teams and investors across the sector especially in payments, asset and wealth management, fund administration, fintech, banks and lenders. As the sector evolves, our focus remains on providing clear advice grounded in sector knowledge and transaction experience.

We look forward to working with clients through 2026 and beyond.